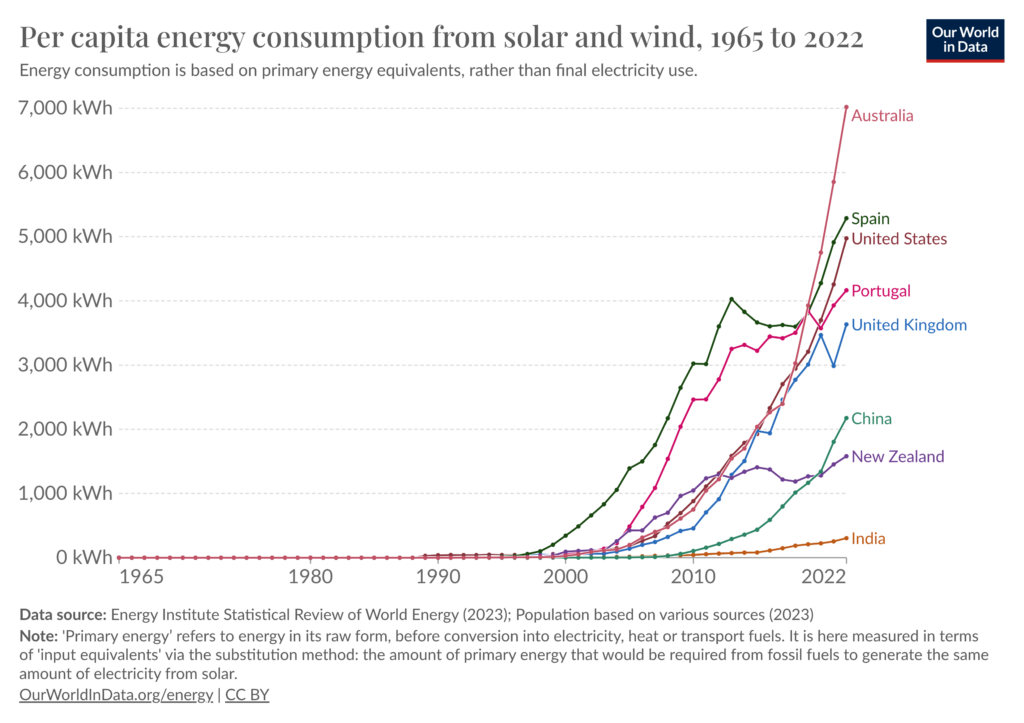

Per capita energy consumption in the U.S. from Solar and Wind has been rising steadily over the last 10 years, where recent years have seen a trend of as much as 3x growth. As renewable sources increase, it is expected that usage of coal based energy consumption will decline by 40% over the next 20 years and likely to be around 29% by 2040.

As the United States starts to climb in the world’s ranking of energy consumption from renewable sources, the question around market leadership and innovation remains to be answered. In order to reach ambitious goals set to reduce carbon emissions it will require a cohesive strategy and partnership across both public and private sector’s. Shifts in consumer behavior will change as distribution models change, and most importantly new infrastructure to distribute power in a new transmission and consumption model.

Per capita energy consumption from solar and wind, 1965 to 2022 – OurWorldInData.org/energy

The move toward natural gas and renewables is expected to increase by a combined 15% by 2040

However, the Department of Energy has set an aspirational goal of reaching 40% of the nations electricity to be supplied by solar in 2035. Outstanding key questions still need to be answered such as; How will this impact the evolution of the grid? How will this impact the solar industry? What technology advances are needed? How will we ensure access to all Americans?

Is setting a decarbonization goal of the grid by 2050 an audacious goal, or a necessary target? Continuing R&D, technology investments and development will be necessary and inspire some people to innovate and create. This vision can be achieved with investments in technology and infrastructure that strives to maintain the consumer’s cost of electricity without unnecessarily driving it up.

Currently the solar industry employs 230,000. Additional economic benefits can be realized through a holistic effort of both emerging technical solutions and services, along with workforce training and private entrants that creates a pathway for private-public collaboration. Current projections for job growth are between 500,000 and 1,500,000 new jobs between now and 2035. Though this won’t magically happen because an economist says it might.

So what does this mean for the mid-market?

How will this affect the mid-market, and what exactly is the mid-market? Mid-market solar is the segment between residential and utility scale projects, often referred to as commercial, or non-residential.

Market size projections for this area are expected to reach $373.8 Billion, a growth of 6% over the next 6 years from $234.8 Billion in 2022.

Possible Future Scenarios

So what scenarios are likely to unfold, what opportunities and changes should we expect? According to the DOE Solar Futures Study three high level scenarios are considered:

- Reference Scenario – where things stay as they are

- Decarbonization Scenario – where we assume policies drive a 95% reduction in carbon dioxide emissions by 2035, and 100% by 2050

- Decarbonization + Electrification (Decarb+E) – which goes further than scenario #2 to consider large-scale electrification use cases for end users.

Considering implications and opportunities for the mid-market it would be in the greatest public interest to explore scenario 3 and focus efforts on Decarbonization + Electrification. This scenario envisions electricity demand being met in 2035, by solar at 45%, wind delivering 45%, and the remainder being met by nuclear, combustion turbines, hydropower, and geothermal.

This opens a doorway and creates opportunity for private industry and public infrastructure to come together, in fact it’s more of an imperative if it’s going to be successful. Unencumbered agile teams could focus on the edges and last mile distribution or advances in hardware. Industry and startups move at an accelerated pace to achieve results since the motivation of a rapidly dwindling capital resource often tends to drive toward a goal of revenue as fast as possible. Conversely this agility is frequently at odds with the pace of regulated public infrastructure and politics.

Where entrants and incumbents will find growth

Imagine what new industries, service and business models could arise from decentralization of the grid. As more Inverter Based Resources are needed to handle the conversion and delivery of AC/DC energy. Storage and transfer systems will need to evolve in order to reach consumers where they are. Rooftops, not only on buildings, but vehicles, transportation networks or neighborhood sub-stations will need to be re-imagined.

Could the milkman delivery of the past for example become the battery delivery service of the future, or will Amazon delivery swap depleted for charged batteries as they deliver goods to your home?

Use Cases and Growth Opportunities

Credits, Sources and Resources

Per Capita Energy Consumption from Solar and Wind – Our World in Data

Science Direct – Electricity Consumption Overview

Department of Energy – Solar Futures Study